You would think that with nearly free money available, inflation would be soaring. So, why don’t we see much inflation? 1 reason this financial excess isn’t causing rampant inflation is that it is flowing into the hands of a ever smaller number of people, and those people don’t (can’t) spend enough of it to inflate prices of everyday items.

Tag: economics

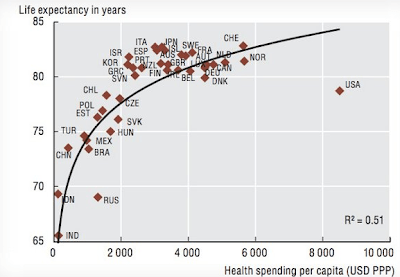

Overpaying 4x for health

why isn’t life expectancy 85 in the us? we’re certainly paying as if it were.

Life extension solvency

it is a huge missed opportunity if you can’t contribute to society in the decades after retirement, and online opportunities might be a way out. whether it is fixing up wikipedia, or teaching kids halfway around the globe your language by video conference. i wrote about this half an eternity ago in 2005

The only realistic way to lower Medicare expenditures and keep the economy afloat is to develop therapies that improve human health and change the culture of retirement.

Student loans

as usual, the onion has the tl;dr version.

China economic reforms

Most notably, there is finally talk about reforming China’s dominant state-owned enterprises, or SOEs. These behemoths suck up the nation’s resources and crowd out the private sector, though they are bloated, inefficient and hamper the development of the economy.

i haven’t seen much discussion on this. also:

The Chinese government will ease its one-child family restrictions and abolish “re-education through labor” camps

Inefficient forms of aid

A group of Occupy Wall Street activists has bought almost $15m of Americans’ personal debt. The low market value of the debt, of course, means these individuals (mostly) would not have paid anyway, so the leveraged return on this investment is not as high as is being claimed.

Great gov IT raises GDP

There’s a new digital divide in this country, and instead of it being between the rich and the poor, it’s between the government and the people that it represents. The pace of technology increases exponentially, and with too much friction on how the government buys things, that gap will continue to exponentially widen.

This is a bad thing because people’s expectations of service directly correlate to the amount of technology available to them. Today, my parents are vacationing in Croatia, and just 5 years ago, I wouldn’t have expected to get any word from them until they return in a few weeks. Today, I get messages from them on a regular basis throughout their trip. My expectations have changed.

And with government it’s the same thing. 10 years ago, when I started on the Dean campaign, there were no meet ups, there were no video conferences, there were no SMS campaigns, there was no iPhone, twitter, myspace or Facebook. Friendster was just getting off the ground.

But today our expectations have changed. And government needs to shift in order to accommodate those expectations, at a cost that’s within the same order of magnitude that we pay.

So please pass this along, if you care about the effectiveness of the services your government delivers to you, or if you care about small, efficient government, this should be an issue for you.

A country will only be as competitive as their gov it Infrastructure. World class it would save 100s of billions a year and would likely show up in GDP growth too.

Shanghai FTZ

the proposed Free Trade Zone in Shanghai will have huge consequences for China’s financial markets and that of the world. It will be a tax-free zone; the RMB will be fully convertible; the FTZ will have its own rules and regulations that cannot be trumped by central government; it will be legally outside the Chinese Customs, in fact a separate territory inside China; it has the effect of abolishing control over capital account investment, so allowing freedom to set up all kinds of companies and moving capital in and out of the FTZ, meaning in and out of China; it will become an international settlement center for international trade and it will allow banks within the FTZ greater flexibility in conducting business. In short, the implications of the development of the FTZ, if the pilot scheme goes smoothly, will be humongous not just for China but for the global economy.

Real Estate lowers GDP

Less developed countries have consistently higher levels of homeownership, while more advanced nations combine higher levels of economic development with substantially lower levels of homeownership.

the reason for this is that real estate is very poor asset allocation: it takes investment away from productive things like lending money to companies, and it makes the workforce unable to go where the jobs are.

Sexual Activity wage effect

We estimate that there is a monotonic relationship between the frequency of sexual activity and wage returns, whilst the returns to sexual activity are higher for those between 26 and 50 years of age.